property tax on leased car in ct

Owners of vehicles registered between October 2 and July 31 pay a prorated amount depending on the date of registration of the vehicle. When you lease a vehicle in.

Insuring A Leased Vehicle Bankrate

The terms of the lease decide which party is responsible for the personal property tax.

. In all cases the tax advisor charges the taxes to the. The fee amount ranges from. The short story I got a K5 GT on lease in 2021 waited forever to get it picked it up April 5th then we had a flood officially a disaster in which.

The property tax liability for a motor vehicle that is leased rather than sold outright to someone remains with the business that holds title to the vehicle ie the. If you paid less than 635 or 775 for vehicles over 50000 sales tax in another state you will need to pay the additional tax to DMV when the vehicle is registered. A dealer who rents a vehicle retains ownership.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. The due date of the tax is usually January 1. If you terminate your lease it.

However the bill is mailed directly to the leasing company since leased cars are registered in the companys name. While Connecticuts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Multiply the vehicle price before trade-in or incentives by the sales tax.

This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease. For example if your. The minimum is 725.

The leasing company is frequently billed by Providences tax collector for taxes. Leased Car Property Tax After Total Loss in Ida. If you didnt get credit.

So if you live in a state with a. Page 1 of 1 Mill Rates A mill rate is the rate thats used to calculate your property tax. A documentation fee doc fee is typically charged by dealers as a kind of administrative fee for both purchased and leased vehicles.

In California the sales tax is 825 percent. In theory the lease agreement establishes who is responsible for paying taxes. Once you have both of these pieces of information you can calculate your vehicle property tax by multiplying the value of your vehicle by the mill rate.

All tax rules apply to leased vehicles. To calculate the property tax multiply the assessment of the property by the mill rate and. This page describes the taxability of.

Auto Lease Buyout Calculator How Much To Buy Your Leased Vehicle Nerdwallet

Leasing A Car And Moving To Another State What To Know And What To Do

1617 1621 W Berry St Fort Worth Tx 76110 Retail For Lease Loopnet

Car Accidents With Leased Cars Adam Kutner Attorneys

Sales Taxes In The United States Wikipedia

Audi Financial Services Car Payment Estimator Leasing Information Audi Usa

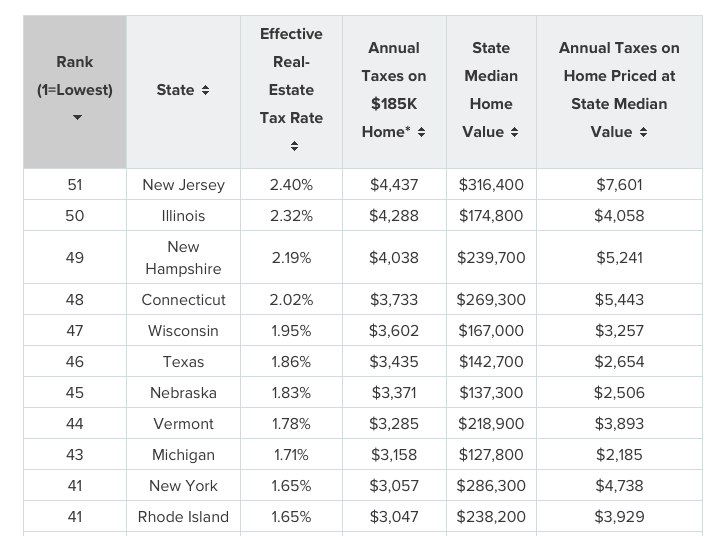

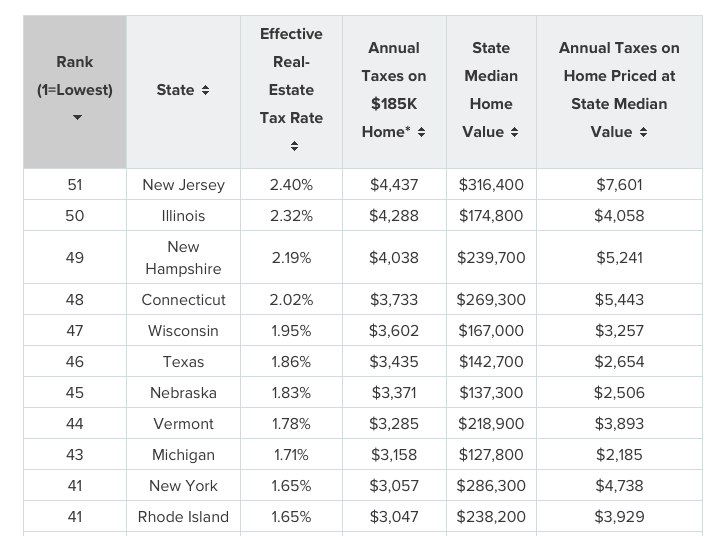

Connecticut Ranked 48th For Property Taxes As State Deficits Threaten To Drive Them Higher Yankee Institute

Do You Pay Sales Tax On A Lease Buyout Bankrate

Bentley Lease Specials Miller Motorcars New Bentley Dealership In Greenwich Ct

Insurance For Leased Cars Vs Financed Cars Allstate

3091 S Jamaica Ct Aurora Co 80014 Loopnet

Car Leasing Return Lease Return Vs Selling A Lease Car Edmunds

Nj Car Sales Tax Everything You Need To Know

Car Lease Deals In Connecticut Swapalease Com

Which U S States Charge Property Taxes For Cars Mansion Global

Is It Better To Buy Or Lease A Car Taxact Blog

Buildings Action Business Brokerage Llc And Elm Realty Advisors