how much is inheritance tax in nc

These are some of the taxes you may have to think about as an heir. Other heirs pay 15 percent tax as a flat rate on all inheritance received.

Death And Taxes Inheritance And Estate Tax In The Carolinas King Law

Charitable and nonprofit organizations dont pay a tax if the amount is less than 500 but 10 percent of anything over the amount.

. However there are sometimes taxes for other reasons. His sister will pay a. For example Indiana once had an inheritance tax but it was removed from state law in 2013.

The inheritance tax of another state may come into play for. A state may exempt a. The inheritance tax rate in North Carolina is 16 percent at the most according to Nolo.

As a descendent over the age of 21 John Does son will pay a 45 percent inheritance tax for a total of 1125. Elliot Marks Author Social Security Advisor. Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance.

Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive. Very few people now have to pay these taxes. There is no inheritance tax in NC.

Heres a breakdown of each states inheritance tax rate ranges. Bank accounts certificates of deposit and investment. The inheritance tax rate in north carolina is 16 percent at the most according to nolo.

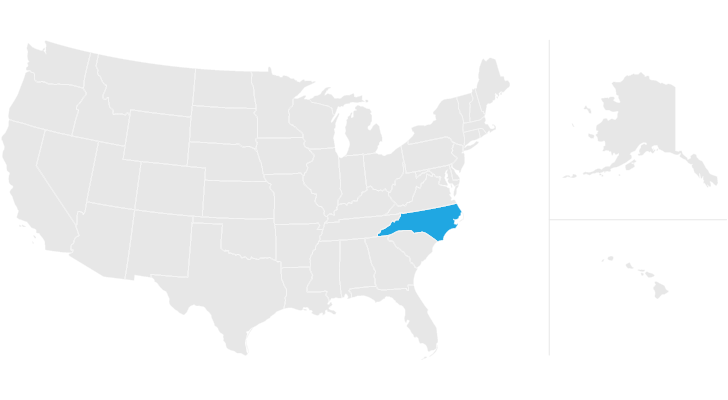

If you inherit property in Kentucky for example that states. North Carolina does not collect an inheritance tax or an estate tax. How Much is Inheritance Tax.

Learn North Carolina income tax property tax rates and sales tax to estimate how much youll pay on your 2021 tax return. If the tax rate for a 40000 inheritance is 10 then you as the taxpayer would owe 4000 in taxes on that inheritance. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

There is no federal inheritance tax but there is a federal estate tax. Fifteen states also have an estate tax. Inheritance taxes are levied on heirs after they have received money from the deceased.

In 2021 federal estate tax generally applies to assets over 117 million. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. A surviving spouse is the only person exempt from paying this tax.

Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance tax in 2015. North Carolina Inheritance Tax and Gift Tax There is no inheritance tax in North Carolina. However state residents should remember to take into account the federal estate tax if.

North Carolina Inheritance Tax and Gift Tax. North Carolina has a flat income tax of 525. No Inheritance Tax in NC.

A surviving spouse is the only person exempt from paying this tax. No Inheritance Tax in NC There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it. If you live in a state that does have an estate tax you may be expected to pay the death tax on the money you inherit from a death in NC.

How Long Does It Take to Get an Inheritance. When someone dies their estate goes through a legal process known as probate. Heres a quick summary of the new gift estate and inheritance changes that came along in 2022.

As of 2015 the first 543 million is exempted from any federal tax. The legal process of dealing with a decedents estate in North Carolina is known as probate. 1-800-959-1247 email protected 100 Fisher Ave.

There is no inheritance tax in North Carolina. The legal process of dealing with a decedents estate in North Carolina is known as probate. Rates and tax laws can change from one year to the next.

The tax rate varies depending on the relationship of the heir to the decedent. For example lets say a family member passes away in an area with a 5 estate tax and a 10 inheritance. All inheritance are exempt in the state of north carolina.

The federal estate and gift tax exemption has been increased from 5000000 in 2017 to 10000000 in. Because the exemption is so large only a tiny percentage of estates roughly 03 have to pay federal estate tax. However there are sometimes taxes for other reasons.

Because the state is free of inheritance tax heirs to an inheritance wont be taxed on it. The inheritance tax of another state may come into play for those living in North Carolina who inherit money. Items included in the deceased persons taxable estate include real estate vehicles and the proceeds from life insurance policies explains Nolo.

Eight Things You Need To Know About The Death Tax Before You Die

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Digital Product On Twitter Financial Aid For College Last Will And Testament Inheritance Tax

Cradled By The Iconic Bighorn Mountain Range Sheridan Extends A Warm Hospitality As Legendary As The Streets Of Histor Wyoming Wyoming Travel Explore Colorado

Online Tax Preparation Services Company Kohari Gonzalez Pllc Income Tax Return Tax Return Income Tax

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

207 N Locust St Black Mountain Nc 28711 Colorado Homes House Black Mountain

What Is Inheritance Tax And Who Pays It Credit Karma Tax

North Carolina Estate Tax Everything You Need To Know Smartasset

Federal Gift Tax Vs California Inheritance Tax

Map Of Earned Income Tax Credit Eitc Recipients By State Map Happy Facts Teaching Geography

North Carolina Estate Tax Everything You Need To Know Smartasset

How To Avoid Estate Taxes With A Trust

North Carolina Estate Tax Everything You Need To Know Smartasset

Pin On Best Divorce Lawyers In Raleigh Nc

In Addition To The Federal Estate Tax Which Is Fourth Highest In The Oecd Many U S States Levy Their Own Estate Inheritance Tax Estate Tax Estate Planning